Get Your Token on Jupiter

How to Get Your Token Verified

All unverified tokens are marked with a '⚠️’ label to encourage users to double-check that the mint addresses are the right ones before trading.

If you've created a token and want to get it verified on the Jupiter Ecosystem List, you can submit your token for review on catdetlist.jup.ag.

For approval, your project needs to:

- Be at least 21 days old

- Have daily volume of more than 10K

- Have a market cap of more than 100K

- Have unique metadata (Symbol and Name does not duplicate another project on the community list)

- Have more than 500 unique holders

Your token does not have to be verified to be tradable. All new pools are supported for instant routing for 14 days before pools get re-evaluated. Remind your users to search via your mint address so they can swap safely!

More resources on the community tag initiative can be found here:

- Community Tag Application Site: https://catdetlist.jup.ag/

- Community Tag FAQ: https://www.jupresear.ch/t/jupiter-community-tag-faq/19168

- Community Tag Overview: https://www.jupresear.ch/t/get-your-token-a-community-tag/18963

- Master Token List API: https://www.jupresear.ch/t/ecosystem-master-token-list/19786

How to Get Your Pool Routed on Jupiter

To provide users access to new tokens, all new markets on supported AMMs are instantly routed for 14 days.

After 14 days, markets that fit the criteria will continue to be routed on Jupiter.

We currently support Fluxbeam, Meteora DLMM, 1Intro, Pump.Fun, Raydium CLMM, Raydium CP, Raydium V4, Whirlpools, Stabble and Obric for Instant Routing.

To ensure your market gets routed on Jupiter after 14 days, your market must fit one of the following criteria:

- Less than 30% price impact on $500

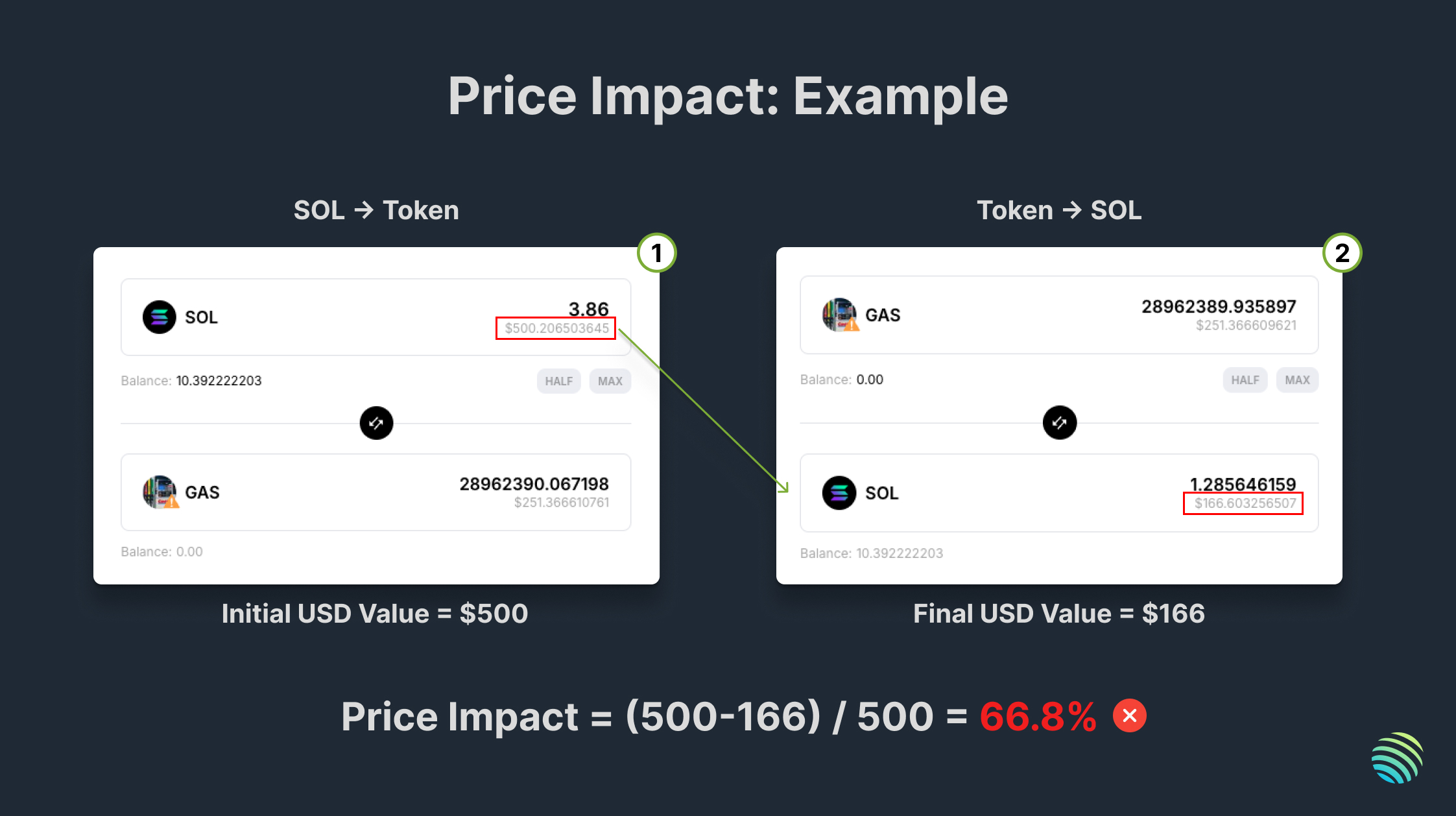

Using a benchmark position size of $500, a user should encounter less than 30% price impact after swapping in AND out of the token from the same pool.

Price Impact = ($500 - Final USD value) / $500

For example, a user swaps $500 worth of SOL into the token, then swaps the same output amount back into SOL. We then use the formula to calculate the price impact percentage.

If the price impact is more than 30%, it means that there is insufficient liquidity in the pool for the benchmark position size of $500.

- (For additional markets) Less than 20% price difference on new pools

For additional markets on already supported tokens, there should be a variance of less than 20% between the new pool and the pool existing in routing.